TrendPro Investing

Start Your Trading Journey

with the Best Broker

Trade financial assets CFDs in Forex, commodities, bonds, metals, energy, stocks, indices, and more with the goal of profiting from price fluctuations in the market.

Open a Free Demo Account

Privilege

Get Exclusive Privileges, A Lifestyle That Fits You

Tournaments

Online Trading

- Active User

K

K - Profit Ratio Per Month

K+

K+ - Net Trade Volume ($)

M+

M+ - Trade Assets

+

+

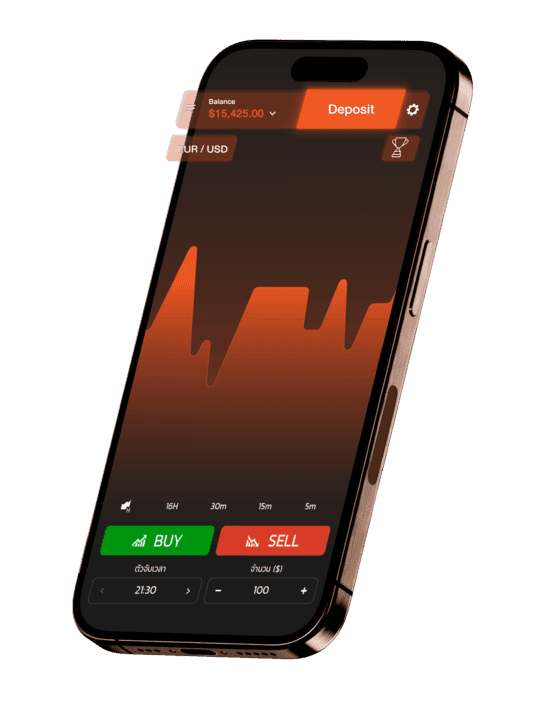

Start Trading Anytime, Anywhere

Download the application on iOS and Android to start trading. More than 8 million clients worldwide trust us and earn daily income.

Stay Ahead of Every Event

Grow within the trading community with expert advice.

Fed Holds Interest Rates, Expects Two Rate Cuts This Year

The U.S. Federal Reserve (Fed) has decided to keep its benchmark interest rate at 4.25%-4.5% during its March 19, 2025 meeting while signaling the possibility of two rate cuts later this year. Despite ongoing economic challenges, including trade tariffs and inflationary pressures, the Fed maintains its cautious approach to monetary policy.

By Trendpro04 May 2025Read more‘Ringgit’ Under Pressure! Global Trade Volatility Pushes Central Bank Toward Rate Cut

The Malaysian ringgit, which was the strongest currency in Asia last year, is now showing signs of weakening amid rising trade tensions. The U.S. has imposed new import tariffs on Chinese goods, impacting Malaysia’s economy and potentially forcing Bank Negara Malaysia to cut interest rates by 0.25%.

By Trendpro04 May 2025Read moreUSD/JPY: Yen Declines as Ueda Stands Firm on Interest Rates Despite Rising Inflation.

Dollar Strengthens as Yen Faces Pressure On Wednesday morning, the USD/JPY pair surged near ¥153.50 following remarks by Kazuo Ueda, Governor of the Bank of Japan (BoJ). Speaking in parliament, Ueda stated that the central bank has no plans to raise interest rates or scale back its stimulus measures anytime soon.

By Trendpro04 May 2025Read morePowell: U.S. economy strong, no rate cuts yet. Addresses tariffs, Musk rumors. Inflation at 3%, Fed may delay cuts.

On February 12, 2025, Federal Reserve Chair Jerome Powell testified before the U.S. House Financial Services Committee as part of the Fed’s semiannual monetary policy report. He emphasized that the U.S. economy remains strong, with a low unemployment rate of 4% and inflation still above the Fed’s 2% target. Powell stated that there is no urgent need to cut interest rates at this time.

By Trendpro04 May 2025Read moreU.S. Inflation Rises 3% in January, Exceeding Expectations, Dampening Hopes for Interest Rate Cuts

Consumer prices in the United States rose higher than expected in January, indicating that inflation has shown little sign of slowing down. This has diminished hopes for a near-term interest rate cut.

By Trendpro04 May 2025Read moreU.S. employment in January 2025 increased by 143,000 jobs, with the unemployment rate dropping to 4%, potentially impacting consumer spending and future inflation.

On February 7, 2025, the United States released its employment report for January, with the following key details:

By Trendpro04 May 2025Read more

Benefits of Trading with TrendPro Investing

Trading with us offers superior benefits with comprehensive services and high security. Our advantages help ensure your trading is efficient and yields the best results, as follows:

Order Execution

Order ExecutionDirect market access

No Fees

No FeesOvernight position holding

Expert Customer Service

Expert Customer ServiceAvailable 24/7

Instant Deposits

Instant DepositsWithin 5 seconds

Easy & Fast Withdrawals

Easy & Fast WithdrawalsWithin 30 seconds

Market Analysis

Market AnalysisBy industry experts

Access Global Markets Anywhere with an Advanced Trading Platform

Accessing global markets anytime, anywhere ensures you never miss an investment opportunity. Forex, commodities, bonds, metals, energy, stocks, indices, and more.